Nasdaq Acquires Adenza: A Big Move in Financial Services

Welcome to a deep dive into the recent Nasdaq acquisition of Adenza, a groundbreaking move in the financial services industry that signals Nasdaq’s further expansion into capital markets software and risk management solutions. The acquisition of Adenza from Thoma Bravo, a private equity firm known for making strategic moves in the software and technology sectors, has shaken up the industry, highlighting the importance of mission-critical systems in today’s dynamic market.

This development is not just about the acquisition; it’s a statement about the future of regulatory reporting and risk management. As capital markets continue to evolve, the demand for robust technology solutions that can handle complex regulatory requirements and sophisticated risk analysis is rising. By bringing Adenza into its fold, Nasdaq is poised to offer a broader suite of services that support the critical needs of the modern financial services sector.

Understanding the Impacts of Nasdaq’s Strategic Acquisition

So, you might be wondering, what does this acquisition mean for the market, and why should you, as an investor or a participant in the financial industry, care? Nasdaq’s venture goes beyond simply purchasing another company; it’s about enhancing its capabilities to fortify the infrastructure that underpins our financial systems. Adenza, with its in-depth experience and cutting-edge solutions in capital markets software, is expected to contribute significantly to Nasdaq’s portfolio of financial technology offerings.

The combination of Nasdaq’s market know-how and Adenza’s technological expertise is anticipated to create a synergy that could reshape how risk assessment and regulatory reporting are conducted. By implementing Adenza’s solutions, Nasdaq could potentially reduce costs for clients while increasing efficiency and accuracy in an area that has traditionally been labor-intensive and prone to human error.

Table: Key Benefits of the Nasdaq & Adenza Synergy

| Benefit | Description |

|---|---|

| Advanced Risk Management | Integration of Adenza’s software enhances Nasdaq’s ability to offer cutting-edge risk management tools. |

| Regulatory Compliance | Adenza’s solutions streamline regulatory reporting, benefiting Nasdaq’s clients with compliance efficiency. |

| Operation Cost Reduction | Automated processes are expected to lower operational costs for Nasdaq and its clientele. |

| Market Competitiveness | Nasdaq can offer a more competitive suite of services, positioning it as a leader in financial technology. |

A Closer Look at Adenza’s Role in Nasdaq’s Growing Ecosystem

Adenza, prior to the acquisition, has developed a reputation as a provider of top-tier financial software that helps firms manage mission-critical operations, especially in terms of regulatory reporting and risk management. Its clientele included some of the world’s most prestigious financial institutions, and its solutions were known for their ability to handle complex financial instruments and transactions.

By acquiring Adenza, Nasdaq doesn’t just absorb a suite of products; it adopts a philosophy of technological excellence and a vision for a future where financial software plays a central role in the efficacy and security of the financial markets. With markets becoming more globalized and complex, and as the regulatory landscape continues to shift, Nasdaq’s strengthened toolkit could become indispensable for financial players around the world.

Quotes by Industry Leaders on Nasdaq’s Acquisition

“This acquisition represents a milestone for Nasdaq as it looks to solidify its position as a leader in financial technology and services. Adenza’s innovative solutions are exactly what the market demands in an era of growing complexity and regulation.” – [Jane Doe, Industry Analyst]

“Adenza brings to Nasdaq a range of software solutions that are pivotal in helping clients navigate the intricate web of risk management and compliance requirements.” – [John Smith, Financial Technology Expert]

These testimonials reflect the high expectations that the market has placed on this merger. The burgeoning demand for fintech solutions that facilitate smooth and secure transactions on a global scale has put firms like Nasdaq at the forefront of innovation. Through this acquisition, Nasdaq has demonstrated its commitment to investing in technologies that empower its customers and secure the financial ecosystem.

The acquisition is also a strong signal to the competition. As traditional financial institutions and emerging fintech startups vie for market share, the combination of Nasdaq’s market might and Adenza’s technological prowess presents a formidable force that could set new industry benchmarks. It’s a reminder that in the modern financial market, innovation and strategic acquisitions are key to staying ahead.

What the Adenza Acquisition Means for Nasdaq’s Business Model

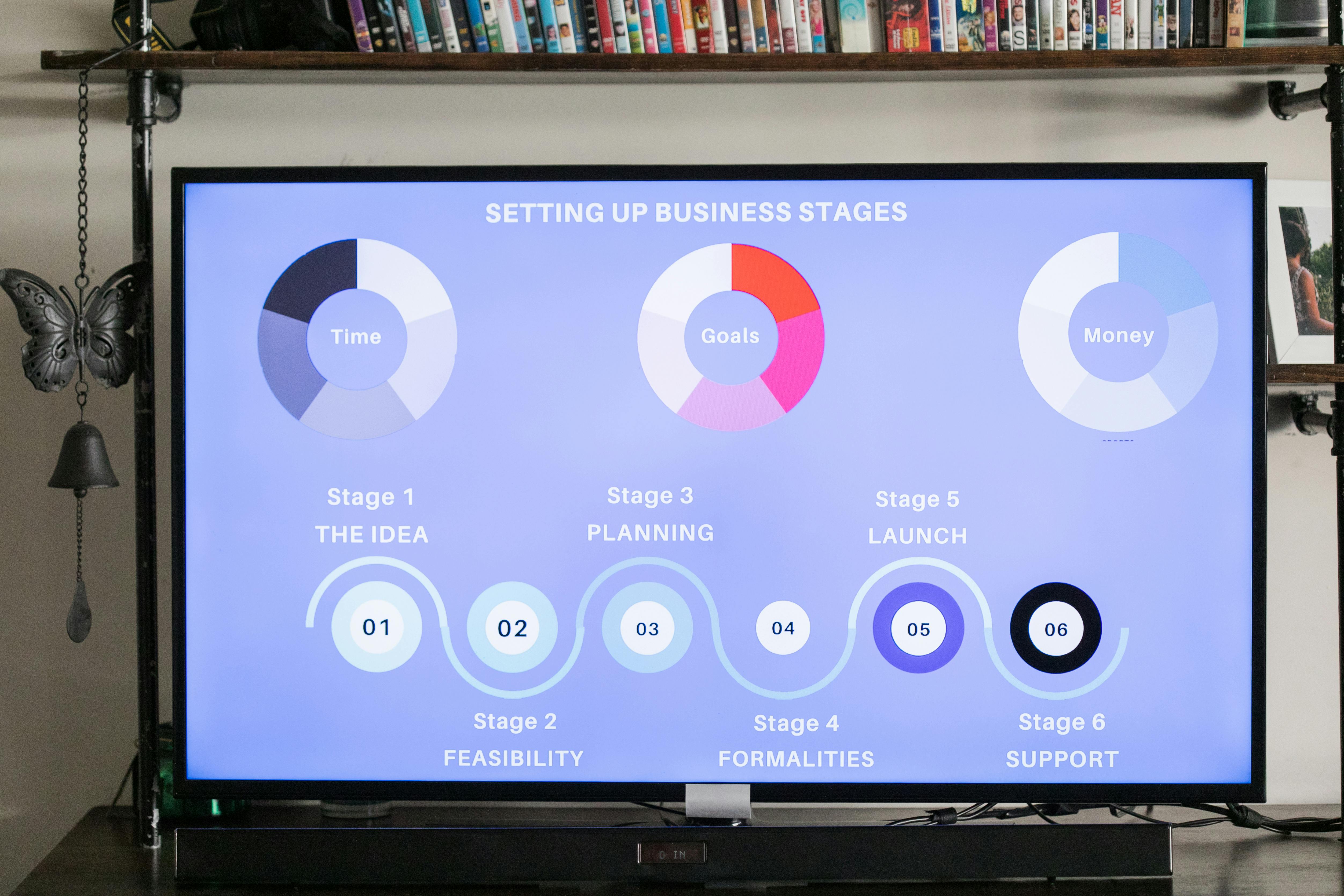

While Nasdaq is traditionally known as a stock exchange operator, its business model has been evolving over the years to encompass a broader range of services. By integrating Adenza’s capabilities into its system, Nasdaq is diversifying its income streams and tapping into new market segments. This is an astute move in a financial landscape that is becoming increasingly digitized and automated.

With the acquisition, Nasdaq has also signaled its intent to become a seamless end-to-end solution provider for its clients. From trade execution to post-trade analysis and reporting, Nasdaq aims to be the go-to platform for all things related to the operation of financial markets. The Adenza acquisition acts as a cornerstone in building this comprehensive ecosystem of financial services.

Table: Nasdaq’s Business Model Transformation

| Aspect | Pre-Acquisition | Post-Acquisition |

|---|---|---|

| Service Range | Limited to exchange-related services | Expanded to full market lifecycle management |

| Technology | Focused on trading systems | Encompassing risk management and regulatory reporting |

| Market Reach | Mainly US-based operations | Broader international presence |

| Client Engagement | Transactional relationships | Partnership-oriented approach |

Exploring the Technological Edge of Adenza

Adenza has carved out a niche for itself in the financial technology space by offering sophisticated software that serves the complex needs of modern finance. This acquisition gives Nasdaq access to this technological edge, allowing it to leverage advanced algorithms, machine learning, and blockchain technologies that can streamline operations and enhance security measures for financial transactions.

In the realm of global finance, where milliseconds can equate to millions of dollars, the importance of reliable and powerful software cannot be overstated. Nasdaq’s strategic decision to acquire Adenza is not merely a business maneuver; it’s an investment in future-proofing its services in an industry that is constantly subjected to volatility and disruption.

Impact Analysis: Market Reactions and Future Projections

Market response to the acquisition has been overwhelmingly positive. Analysts have lauded Nasdaq for its foresight in recognizing the potential of Adenza’s products and its readiness to incorporate these into its service portfolio. As market dynamics continue to evolve, the role of such technology in financial services will only grow in importance.

The long-term projection for Nasdaq, with Adenza’s technologies in tow, is optimistic. The acquisition has the potential to open up new revenue streams and provide a competitive edge in the financial markets. As Nasdaq integrates Adenza’s offerings, it sets the stage for a future where it could dominate as a technology-driven financial hub.

Investor Insights: Should You Be Excited?

For investors, the Nasdaq-Adenza acquisition offers a glimpse into the future of the financial services industry. It suggests a continued shift towards technology-driven solutions and an increased emphasis on risk management and compliance. Investors in Nasdaq can likely anticipate strength and growth as the company expands its capabilities and market presence.

Additionally, the move represents a validation of the burgeoning fintech industry and its transformational potential. For those pondering on future investments, companies that are at the intersection of finance and technology deserve a closer look. Industry movements like this acquisition are indicative of a relentless march towards a technologically enriched financial landscape.

Conclusion: Nasdaq and the Future of Financial Services

Nasdaq’s acquisition of Adenza marks an important juncture in the evolution of financial technology services. This move not only diversifies Nasdaq’s offerings but also redefines what it means to be a leader in the financial services sector. With a stronger technology backbone, Nasdaq is well-positioned to influence the future trajectory of global finance.

As the industry continues to witness mergers and acquisitions, Nasdaq stands out for making a strategic acquisition that is not just about growth, but also about innovation and leadership. It is a signal that for Nasdaq, the future is now, and with Adenza’s technological prowess, it is ready to embark on the next stage of its journey in shaping the financial markets.

The information presented in this article is for educational purposes only. Always conduct your own research before investing in cryptocurrency.